Parcel carriers and National Posts sadly lose market share to Amazon Pay

In this article you will understand how Amazon Pay actually takes market share from National Posts and parcel carriers on the e-commerce market. This article covers Amazon’s logistics and payment evolution, the impact of Amazon Pay on European parcel carriers, and strategic insights into why Amazon’s integrated payment and delivery services are gaining ground.

Introduction: Amazon’s evolution from a small marketplace to logistics powerhouse

Amazon’s evolution from a niche online bookstore in the United States to a global retail and logistics titan has been one of the most transformative developments in e-commerce and delivery services over the past two decades. Initially focused on providing consumers with a simple platform to purchase books online, Amazon rapidly expanded its catalog to include electronics, clothing, household items, and virtually every category of goods.

As Amazon’s e-commerce operations grew, so did its investments in logistics, which eventually led to the establishment of Amazon Logistics—a comprehensive shipping and delivery network that provides last-mile solutions directly to customers, bypassing many traditional carriers. This article will explore Amazon’s journey into logistics, and more specifically, how Amazon Pay, an express checkout solution, is fundamentally reshaping the competitive landscape in Europe.

It examines how Amazon is not only transforming the checkout process on e-commerce platforms but also disrupting the market share traditionally held by parcel carriers like DHL, GLS, DPD, and national postal services such as Royal Mail, La Poste, Posti, and PostNL.

Table of Contents

The rise of Amazon Logistics and the expansion into European markets

Amazon Logistics has become an integral part of the company’s identity, allowing Amazon to offer ultra-fast delivery options to customers worldwide, including same-day, next-day, and Prime delivery services that cover an impressive range of regions. This powerful logistics arm enables Amazon to control the entire delivery process for its orders, creating an experience that many customers find faster and more reliable than those offered by traditional parcel carriers and postal services.

Amazon entered the European market with logistics services focused on enhancing its e-commerce capabilities and meeting the needs of a fast-growing customer base. In Europe, Amazon Logistics introduced sophisticated infrastructure and delivery systems to support its retail operations, setting up regional hubs and investing in technology that helps streamline everything from warehousing to last-mile delivery.

As a result, Amazon has carved out a substantial portion of the parcel delivery market in Europe, challenging established players who have historically dominated the logistics sector.

Amazon is disrupting the market share traditionally held by parcel carriers.

How Amazon Pay is gradually capturing market share from European parcel carriers

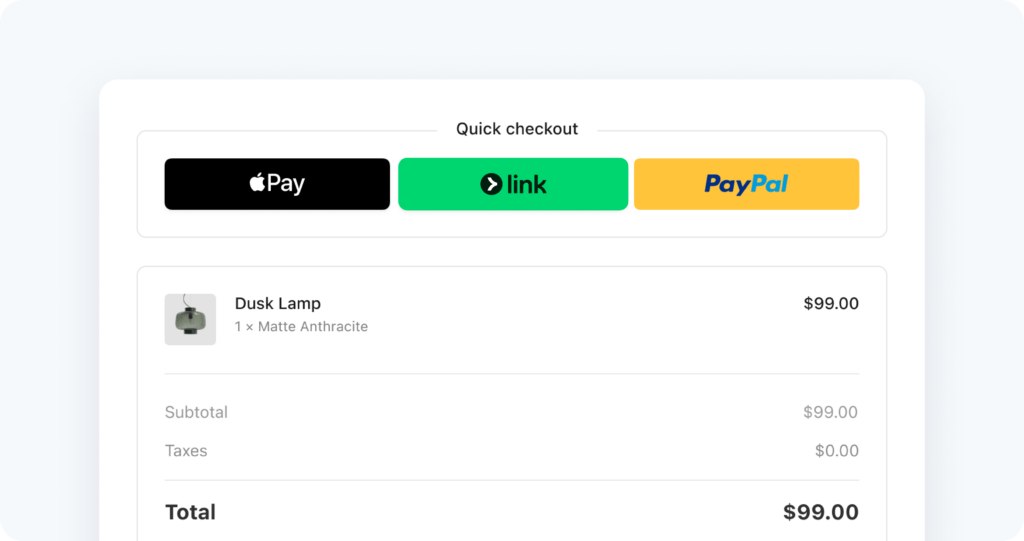

Amazon Pay’s rise has introduced a new layer of competition in the e-commerce landscape, contributing to Amazon’s increasing market share at the expense of traditional parcel carriers. As consumers gravitate toward express checkout options, they often opt for merchants that support Amazon Pay, which provides a seamless and speedy payment experience.

Many e-commerce platforms report higher conversion rates when offering Amazon Pay, as its one-click system reduces cart abandonment. This shift has drawn e-buyers away from traditional checkout methods that are often slower and more cumbersome, making it clear why Amazon Pay is capturing market share in Europe from parcel carriers.

Amazon’s unified ecosystem—a combination of Amazon Pay, Prime membership, and Amazon Logistics—allows customers to complete transactions and receive their purchases with minimal friction, appealing to the fast-paced, convenience-oriented mindset of modern e-consumers. This convenience factor is a compelling reason why Amazon’s services continue to attract market share, directly competing with the delivery services of traditional parcel carriers and postal systems.

Challenges faced by traditional parcel carriers in Europe

Traditional parcel carriers such as DHL, GLS, and DPD face several challenges in Europe as they attempt to keep pace with Amazon’s highly efficient logistics and payment system. For one, the logistics and delivery networks in Europe are complex and often fragmented, with various carriers operating in specific regions, subject to local regulations that can create logistical bottlenecks and cost inefficiencies.

Amazon, by contrast, has established a streamlined network that relies on optimized routes, automated fulfillment centers, and advanced tracking systems, reducing operational costs and improving delivery speeds. Additionally, many traditional parcel carriers are struggling to keep up with evolving consumer expectations, as e-buyers increasingly demand faster delivery times, real-time tracking, and improved transparency in delivery services.

Amazon’s ability to meet these expectations through its vertically integrated logistics operations gives it a significant edge over traditional parcel carriers, who often lack the same level of direct control over the last-mile delivery experience.

How Amazon Pay promotes Amazon Logistics and impacts parcel carriers

Amazon Pay has become more than just a payment solution; it indirectly promotes Amazon’s own logistics services, particularly for Prime members who prioritize speed and reliability. By using Amazon Pay, consumers are more likely to choose sellers that offer Prime delivery, resulting in increased volumes for Amazon Logistics rather than for traditional parcel carriers.

This synergy between Amazon Pay and Amazon Logistics puts Amazon in an advantageous position, as it allows the company to capture a larger portion of the delivery market from established parcel carriers in Europe. For example, when customers use Amazon Pay on non-Amazon websites, they can still enjoy the benefits of Amazon’s streamlined logistics system if the retailer partners with Amazon for fulfillment.

This setup not only encourages retailers to integrate Amazon’s logistics services into their supply chain but also reinforces Amazon’s market share by making it difficult for traditional carriers to compete.

Case studies of Amazon’s competitive edge over European parcel carriers

Amazon’s impact is perhaps most evident when looking at its competition with well-established parcel carriers in key European markets. In Germany, one of Amazon’s largest international markets, Amazon’s logistics services have grown significantly, creating a direct challenge to DHL and GLS, two leading parcel carriers in the region.

By providing faster delivery options at competitive prices, Amazon has become a preferred choice for many online shoppers, which forces local parcel carriers to invest heavily in technology and infrastructure to maintain their position. In the United Kingdom, Amazon Logistics has similarly impacted Royal Mail, the national postal service. While Royal Mail remains a staple for traditional mail delivery, it has struggled to compete with Amazon’s advanced logistics network, which is designed to meet the demands of e-commerce.

A similar trend is seen in France, where Amazon’s logistics expansion has challenged La Poste’s long-standing dominance. These case studies demonstrate that Amazon’s combination of Amazon Pay and Amazon Logistics is more than capable of challenging even the most established parcel carriers across Europe.

Consumer behavior in Europe and the preference for One-Click payments

Consumer behavior across Europe has shifted dramatically in favor of digital and mobile payments, driven by a desire for simplicity and convenience. The rapid rise of one-click payments aligns well with this trend, as consumers now prioritize ease of use when selecting payment methods. Amazon Pay, with its one-click checkout solution, is well-positioned to meet these expectations, offering e-buyers a convenient and familiar payment option.

This trend is not only reshaping payment preferences but is also directly influencing which delivery services are preferred by consumers. Many e-commerce retailers have adopted Amazon Pay to capitalize on this shift, drawing customers who may otherwise choose platforms that rely on traditional parcel carriers.

The influence of Amazon Pay on cross-border E-Commerce in Europe

Amazon Pay has also played a pivotal role in facilitating cross-border e-commerce in Europe, an area where many parcel carriers face logistical challenges. Cross-border shopping often involves complex customs procedures and varying delivery standards, which can discourage consumers from purchasing from foreign websites.

However, Amazon Pay simplifies this process by allowing consumers to make purchases quickly and securely, while Amazon Logistics can ensure that cross-border deliveries are timely and reliable. This ability to support cross-border e-commerce gives Amazon a substantial competitive advantage, particularly as more European consumers look to buy products from neighboring countries.

One of the most promising strategies is for these carriers to develop their own express checkout solutions, which can simplify and speed up the purchasing experience. By partnering with fintech companies, parcel carriers can accelerate the launch of these solutions.

Strategies parcel carriers compete with Amazon Pay and Amazon Logistics

As Amazon continues to capture market share, traditional parcel carriers have begun implementing various strategies to retain their customer base. Many are investing in digital transformation initiatives, improving their payment options and delivery tracking capabilities to compete with the simplicity and efficiency offered by Amazon.

Additionally, some parcel carriers are forming strategic partnerships with fintech companies to create alternative payment solutions that rival Amazon Pay, providing consumers with more choices at checkout. Moreover, in an effort to differentiate themselves, some carriers are placing a greater focus on B2B delivery services or specialized delivery options, such as environmentally friendly solutions, which appeal to a niche segment of consumers.

The future of Amazon Pay and its potential impact on the European logistics market

Looking forward, Amazon Pay’s growth trajectory suggests that it will continue to expand its influence in the European market, further impacting traditional parcel carriers. With increased adoption by e-commerce retailers, Amazon Pay is likely to become an integral part of online shopping experiences in Europe, especially as consumer demand for convenience and speed remains high.

However, Amazon may also face regulatory hurdles as European authorities scrutinize its market practices, especially in regard to monopolistic tendencies. Despite these potential challenges, Amazon’s continued integration of logistics and payment solutions could signal a profound shift in how parcel delivery operates in Europe.

Conclusion: adapting to a new era in European parcel delivery

Amazon’s influence in Europe’s logistics and e-commerce market has shown how integrated, seamless payment and delivery solutions can drive market share, leaving traditional parcel carriers and national postal services facing significant disruption. The combined power of Amazon Pay’s express checkout and Amazon Logistics’ efficient last-mile delivery has set new standards for speed, convenience, and customer satisfaction—qualities that today’s e-commerce consumers expect.

To remain competitive, traditional parcel carriers like DHL, DPD, and national posts such as La Poste and Royal Mail must adapt quickly to these changing market dynamics. One of the most promising strategies is for these carriers to develop their own express checkout solutions, which can simplify and speed up the purchasing experience. By partnering with fintech companies, parcel carriers can accelerate the launch of these solutions, leveraging fintech expertise in digital payments to provide a smooth, secure checkout process that rivals Amazon Pay. This approach not only boosts customer conversion rates for e-commerce retailers but also allows parcel carriers to retain control of the delivery process.

A robust, branded express checkout solution can position parcel carriers as more than just logistics providers; it transforms them into essential partners in the e-commerce journey, appealing to both consumers and businesses. Through such a fintech partnership, traditional parcel carriers can reclaim market share, offering retailers an alternative to Amazon’s ecosystem and reinforcing their relevance in the fast-evolving world of European e-commerce logistics. This proactive move can enable parcel carriers to meet modern customer expectations, delivering the speed, transparency, and convenience that are increasingly critical to retaining their market position.

Post Tags:

Blog News

Other articles from Octopay

Find all Octopay articles, tips and market studies about the express checkout and click-to-pay ecosystem. Get started today!