How Shopify’s game-chanching Shop Pay is stealing market share from banks

In this article you will understand how Shop Pay solution from Shopify actually takes market share from Payment Services Prodiders, Banks and Fintechs on the e-commerce market.

Introduction: Shop Pay is capturing market share in Europe from traditional online payment providers

In recent years, the e-commerce landscape has evolved significantly, particularly with the growing consumer preference for fast, one-click payment options. In Europe, this trend is altering the dynamics of online payment, as consumers increasingly opt for streamlined solutions that bypass traditional methods.

At the forefront of this change is Shop Pay, Shopify’s integrated payment system, which is capturing substantial market share from established online payment providers, including banks and fintech companies. In this article, we explore how Shop Pay’s one-click functionality, embedded payment advantages, and simplified checkout process are transforming e-commerce in Europe.

Table of Contents

Understanding Content Management Systems (CMS) in E-commerce

A Content Management System (CMS) is a platform or software application that enables businesses to create, manage, and update content on their websites without extensive technical skills. In the realm of e-commerce, a CMS provides the essential tools for managing product listings, inventory, pricing, and customer experience. For businesses of all sizes, an effective CMS streamlines the backend processes necessary to present products, handle transactions, and maintain essential storefront functions. As a result, it’s a core component for any online retailer aiming to provide a high-quality shopping experience.

E-commerce CMS platforms also support flexibility, enabling companies to add features and tools to personalize customer experiences. In a fast-evolving digital market, CMS platforms make it possible for businesses to stay competitive, efficient, and aligned with changing consumer demands.

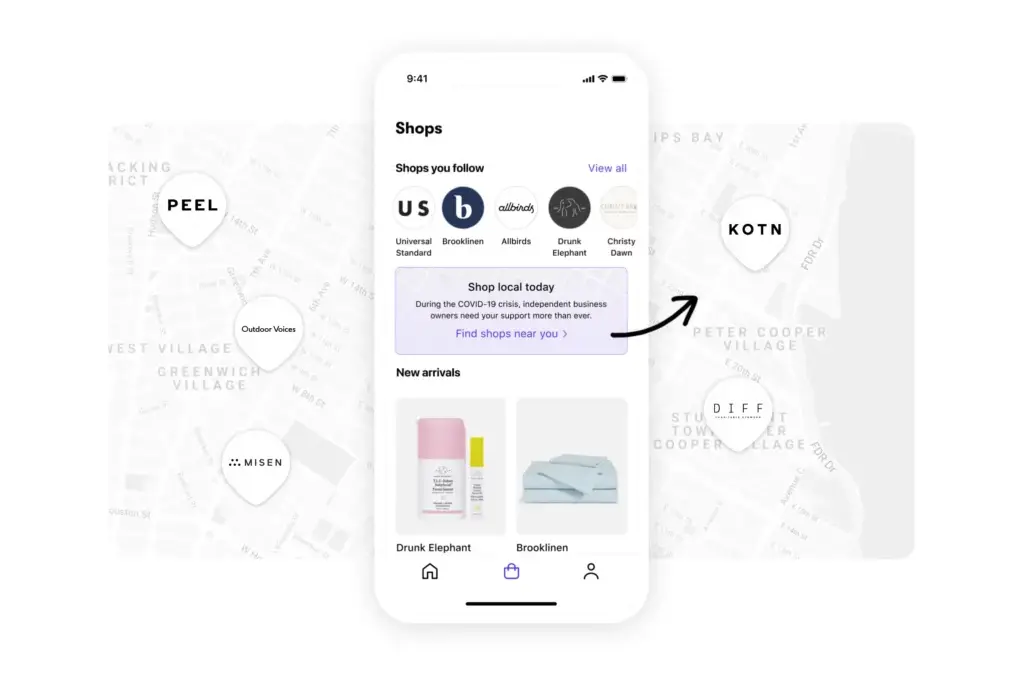

Shopify stands out as one of the world’s most popular CMS platforms for e-commerce, powering over 1.7 million businesses globally. Known for its user-friendly design and versatility, Shopify enables companies to build, manage, and grow their online stores with ease. Its reputation as a top CMS comes from its wide range of services, including customizable website themes, integrated SEO tools, and seamless connections to social media platforms.

Shopify’s success as a CMS platform stems from its continuous efforts to expand functionality for merchants. Over time, Shopify has added marketing tools, shipping solutions, and payment options, including its proprietary payment processor, Shop Pay. This growth showcases how Shopify has shifted from being a CMS provider to a holistic e-commerce solution, meeting diverse business needs from a single, integrated platform.

E-commerce businesses choose Shopify not only for its ease of use but also for its scalability, which supports businesses as they grow. Shopify’s platform allows merchants to start with basic features, then add on advanced functionalities like abandoned cart recovery, analytics, and marketing automation as they scale up. Additionally, Shopify supports a wide range of third-party integrations, allowing companies to customize and tailor their e-commerce experiences.

For European merchants, Shopify’s localization capabilities and compliance with regional payment regulations make it an ideal CMS for businesses selling across borders. With Shopify, businesses can tap into a robust system that simplifies management tasks, improves the customer journey, and ultimately, drives higher conversion rates.

This evolution reflects a shift in Shopify’s strategy to become a one-stop shop for e-commerce businesses.

The evolution of Shopify: from CMS to all-in-one E-commerce solution

Since its inception, Shopify has grown far beyond the role of a traditional CMS. Initially designed to help small businesses build online stores, Shopify’s platform now includes an array of tools to support every aspect of online retail. Shopify’s services have expanded from storefront management to include logistics, digital marketing, and even payment processing. This evolution reflects a shift in Shopify’s strategy to become a one-stop shop for e-commerce businesses.

Shopify’s transition into payments started with its proprietary solution, Shop Pay, which is now widely used among Shopify merchants. By integrating payment processing within its existing platform, Shopify simplifies checkout for both merchants and customers, reinforcing its position as a comprehensive e-commerce solution rather than a simple CMS.

Shopify’s move into the payment sector with Shop Pay

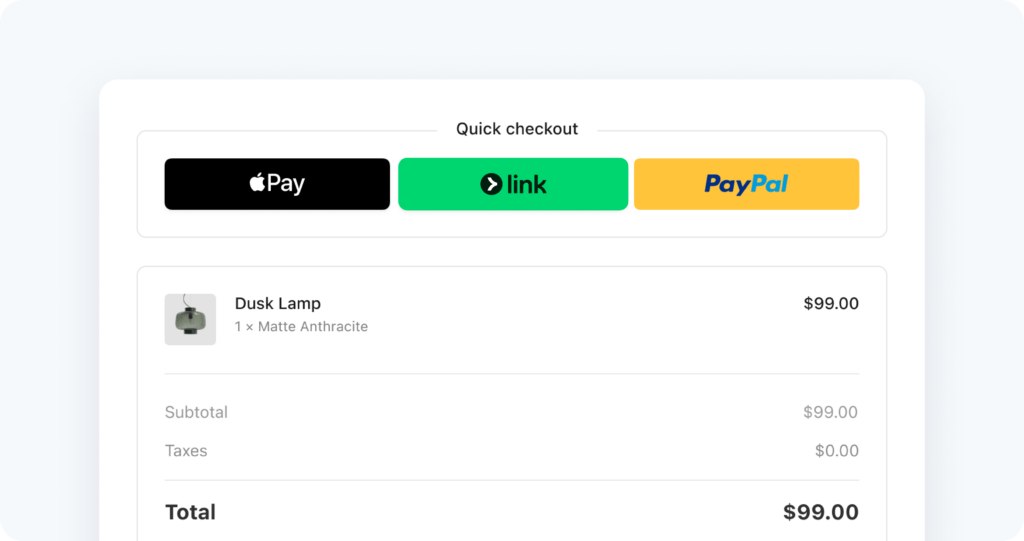

Shopify recognized the potential to increase value for merchants by providing an in-house payment solution. The launch of Shop Pay represented a strategic move to capture payment processing revenues and offer an experience optimized for e-commerce. Shop Pay simplifies the checkout experience by enabling quick, secure one-click payments, which reduce friction and improve conversion rates.

With the addition of Shop Pay, Shopify has not only diversified its revenue streams but also strengthened its ecosystem. Shop Pay has grown rapidly, providing Shopify with a competitive edge over traditional payment providers by offering a seamless solution that blends perfectly with the rest of its platform.

Shop Pay integrates effortlessly into the Shopify ecosystem, enhancing the overall experience for both merchants and customers. By providing a single, unified solution, Shop Pay eliminates the need for third-party payment providers, which can sometimes complicate the checkout process. For merchants, this integration allows for easy management of payments, reduced reliance on external providers, and better data insights to understand customer behavior.

For customers, Shop Pay offers a simplified checkout experience, reducing the steps required to complete a purchase. This ease of use not only increases satisfaction but also addresses a key issue in e-commerce: cart abandonment. By eliminating unnecessary steps, Shop Pay helps merchants retain more customers and close more sales, giving them a clear competitive advantage in the digital marketplace.

Why e-buyers prefer one-click payments

In today’s fast-paced world, e-commerce consumers increasingly seek convenience and speed. Traditional checkout processes, which involve entering payment and shipping information manually, create friction that can lead to abandoned carts. One-click payments, like those enabled by Shop Pay, cater to this shift by offering a streamlined experience that minimizes effort and time spent at checkout.

Consumers now expect a checkout experience similar to that provided by leading platforms such as Amazon and Apple, where purchases can be completed in seconds. One-click payment solutions address this need for speed and simplicity, making them highly appealing to online shoppers.

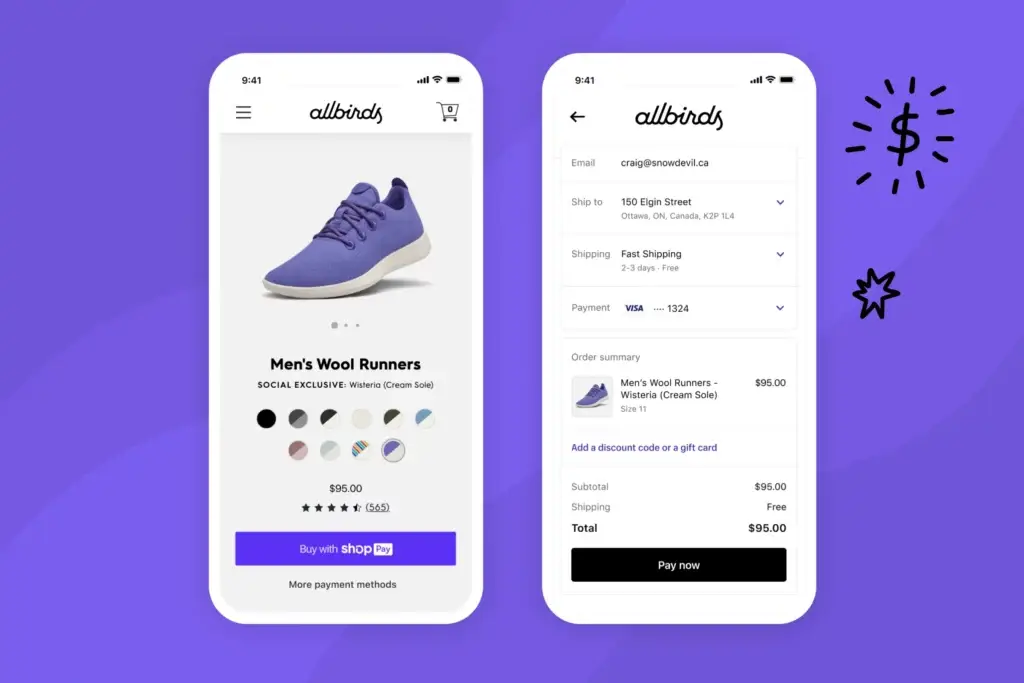

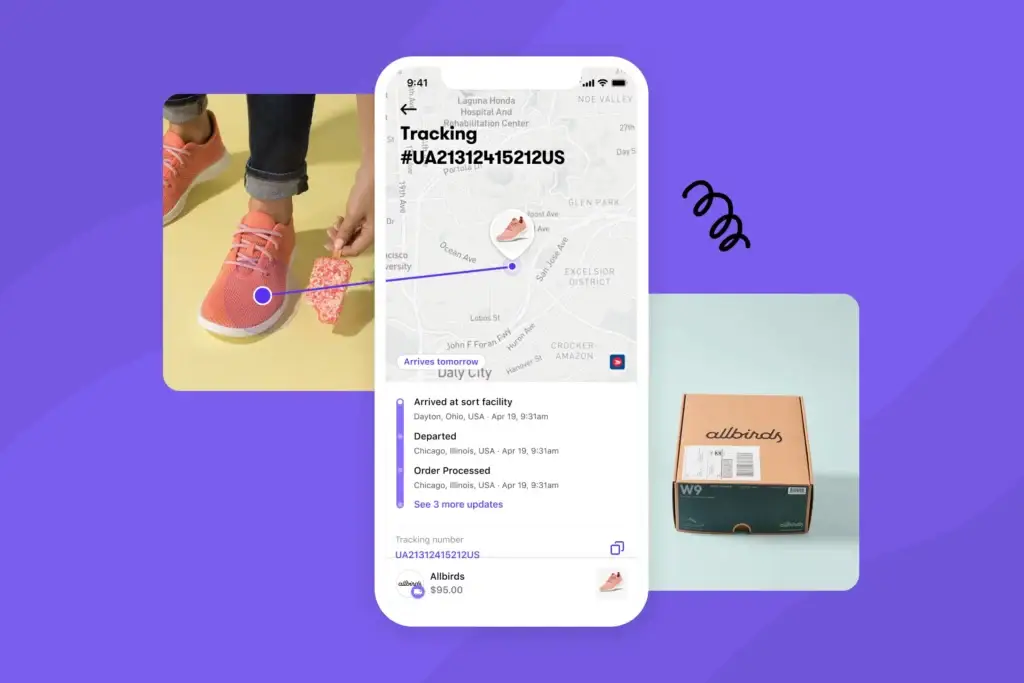

Shop Pay was introduced as Shopify’s answer to the demand for one-click payments. With Shop Pay, customers can securely save their payment details and shipping preferences, allowing future transactions to be completed with just one tap. This feature is particularly beneficial for repeat customers who make frequent purchases from Shopify stores.

Shop Pay’s one-click model doesn’t just enhance the customer experience; it also benefits merchants by increasing conversion rates. By removing friction from the checkout process, Shop Pay significantly reduces cart abandonment rates and helps merchants capture more sales. Compared to other one-click payment solutions, Shop Pay’s integration with Shopify gives it a unique advantage, making it a popular choice for merchants looking to optimize their checkout flow.

Cart abandonment is one of the biggest challenges in e-commerce, with studies showing that over 70% of online shopping carts are abandoned. The reasons vary, but complicated or lengthy checkout processes are common factors. Shop Pay simplifies checkout, allowing customers to complete their purchases quickly and easily, which helps to prevent cart abandonment.

For European merchants, who often face higher cart abandonment rates due to the complex checkout processes required by different payment providers, Shop Pay offers a solution that is both straightforward and consistent. By enabling faster transactions, Shop Pay helps businesses retain customers who might otherwise leave without completing their purchase, contributing to increased sales and customer loyalty.

Shop Pay’s competitive edge in the European Market

Traditional payment providers, such as banks and independent payment gateways, generally require more steps to complete transactions, and often charge fees for each transaction. In contrast, Shop Pay is optimized for e-commerce and comes with a simplified, merchant-friendly fee structure that can be more economical, particularly for small and mid-sized businesses.

Shop Pay’s advantage lies in its seamless integration with the Shopify ecosystem, which eliminates the need for third-party payment processors. This allows merchants to provide a faster, easier checkout experience. For consumers, the speed and security of Shop Pay are appealing, as it saves them the hassle of repeatedly entering their payment and shipping information.

With the rise of digital payments, security is a critical concern. Shop Pay addresses this with multiple layers of protection, including end-to-end encryption and two-factor authentication, which keeps customer information secure. Additionally, Shopify is committed to complying with GDPR and other European regulations, making it a trusted choice for both merchants and buyers in Europe.

This level of security is especially reassuring for e-commerce customers, who may be reluctant to store their payment details online. Shop Pay’s reputation for secure transactions builds trust, encouraging repeat purchases and enhancing customer loyalty. For merchants, the reduced risk of fraud and data breaches is another reason to opt for Shop Pay over traditional providers.

Shop Pay’s ability to streamline and secure the payment process has been shown to improve conversion rates for merchants. By offering a simplified, one-click checkout experience, Shop Pay reduces the friction that often leads to cart abandonment. Merchants who adopt Shop Pay typically see higher completion rates, as the process is fast, intuitive, and safe.

Case studies have demonstrated that European businesses using Shop Pay report significant improvements in their sales performance. Shop Pay’s integration with Shopify also provides valuable data insights, allowing merchants to monitor conversion rates and optimize their sales strategies for even better outcomes.

Market impacts: Shop Pay vs. Banks, Fintechs, and Payment Providers

As Shop Pay gains popularity, it is starting to pull market share away from traditional banks and payment providers in Europe. This shift is due to Shop Pay’s streamlined experience and lower transaction fees, which appeal to both merchants and consumers. Unlike banks, which often have lengthy and formal processes for online payments, Shop Pay allows for a frictionless experience designed for e-commerce.

By offering a unified solution, Shopify has created an environment where Shop Pay is the preferred choice for merchants on its platform. Traditional providers now face the challenge of adapting to the expectations set by one-click solutions or risk losing market share to embedded options like Shop Pay.

Shop Pay’s rise poses an interesting question for fintech companies: should they view Shop Pay as competition or seek opportunities for collaboration? While some fintechs may choose to compete directly by enhancing their own one-click payment options, others may find it advantageous to partner with Shop Pay to access Shopify’s extensive merchant network.

Collaboration between Shop Pay and fintech companies could lead to innovative payment solutions that benefit both parties. In this evolving landscape, traditional providers may look to partnerships as a way to stay relevant and leverage Shop Pay’s popularity to reach new markets.

As Shop Pay continues to capture market share, traditional providers are being forced to adapt. Banks and other payment processors in Europe are now working to innovate and modernize their payment systems to better compete with embedded solutions. Some are investing in new technology, while others are launching their own one-click payment features to provide a similar experience to Shop Pay.

To remain competitive, traditional providers will need to prioritize speed, security, and ease of use in their payment solutions. They may also need to reevaluate their fee structures to attract businesses looking for more cost-effective options. Shop Pay’s success signals a clear need for evolution in the payments industry, especially as e-commerce continues to expand.

Post Tags:

Blog News

Other articles from Octopay

Find all Octopay articles, tips and market studies about the express checkout and click-to-pay ecosystem. Get started today!